taxing unrealized gains reddit

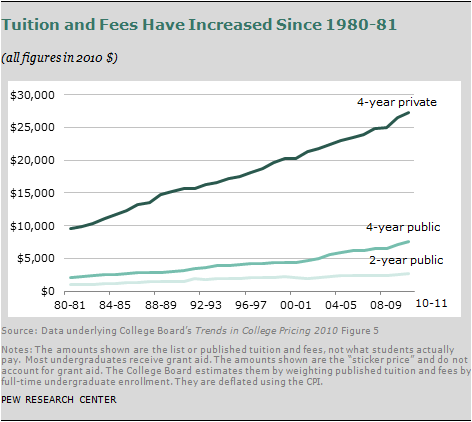

Curious how this works in practice if you have a large unrealized gains but not a lot of cash on hand. Lawmakers are considering taxing the unrealized capital gains of billionaires as a way to raise money to help pay for President Joe Bidens broad social and climate spending plans.

How Democrats Are Targeting Billionaires With New Wealth Tax Plan Youtube

In other words if an asset is projected to make money but you dont cash in on that.

. So even if I have not sold a single sneaker the government says youve had a 490000 unrealized gain we tax that at 15 so you owe 73500 in taxes. That said the sold stocks that bring gains or losses are realized. The government does not accept.

Not to insult anyones intelligence but unrealized capital gains are those youve made on an asset you havent sold yet. Taxing Unrealized Capital Gains. As they explain it The wealthy pay low income tax rates year after year for two primary reasons.

Below are one economists estimates of what the top 10 wealthiest. Posts by ThePoliticalHat 2020-03-22 164502 Report. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

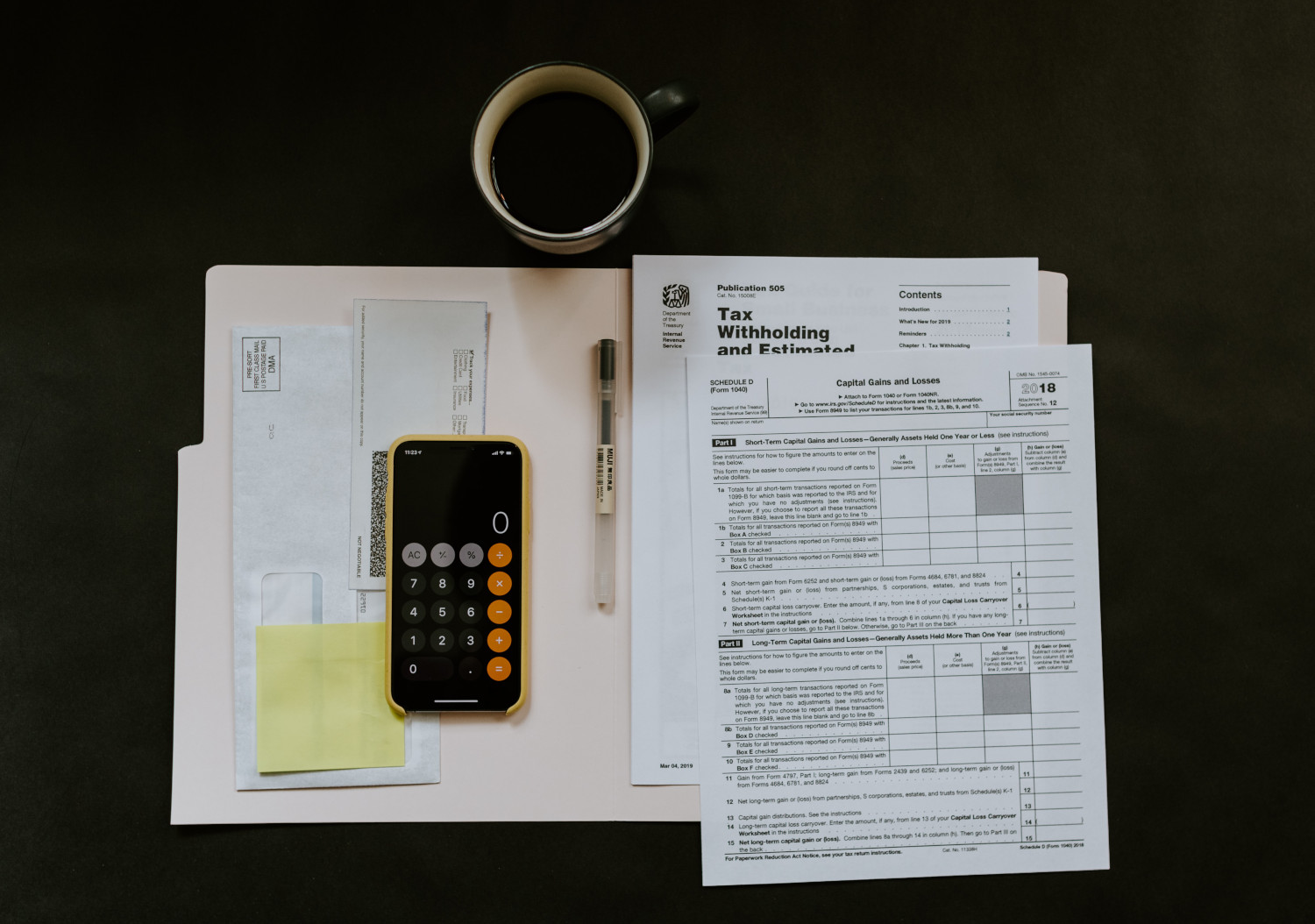

The asset doesnt have to be. Tax law that would. Wyden has been working on the idea of annual taxes on unrealized gains for several years and its adoption would mark a significant change to US.

Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates with each passing year can avoid paying income taxes on that. An unrealized gain refers to the potential profit you could make from selling your investment. Requiring investors to pay taxes annually on their unrealized gains would end a longstanding rule that says levies arent due to the IRS unless an asset is sold Thats from the article and I like.

It would affect people with 1 billion in assets or those who have reported at. A Bad Idea That Just Wont Die Conservative Original. How would such a policy work.

Senate Finance Committee Chairman Ron Wyden D. Taxing unrealized gains is taxing an asset as if it were liquidated at current market rates. If you decide to sell youd now have 14 in realized capital gains.

The downside is there will be much less stock investment as you cannot let gains grow. First much of their income is taxed at preferred rates. Am I to understand theres an unrealized cap gains tax.

China Stopped Testing for COVID-19. Billionaires could be taxed on unrealized capital gains on their liquid assets Democratic officials said yesterday. But of course this only happens when there is an act of selling.

One of the features of President Joe Bidens new budget proposal is to impose taxes on unrealized capital gains. Until the stock is sold the gain or the loss is unrealized. They only exist on paper.

Live Free or Die. If the collateral was collected the owner would be taxed when the sale was made to square up on the debt. As per article below janet yellen is considering introduction of taxes on unrealized stock gains.

Biden also called for the top capital gains tax rate to be the same as his top proposed rate on other income at 396. Reddits home for tax geeks and. The bonus for the government is they can tax your gains every year as the stock grows.

At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains.

Gamestop Hearing Part 2 C Span Org

Long Term Vs Short Term Capital Gains Tax

How Could Changing Capital Gains Taxes Raise More Revenue

Opposed To The Unrealized Capital Gains Tax R Elonmusk

![]()

How Is The Unrealized Capital Gains Tax Supposed To Work R Neoliberal

How Is The Unrealized Capital Gains Tax Supposed To Work R Neoliberal

Biden Backs Tax On Billionaires Unrealized Investment Gains R Fatfire

Rethinking How We Score Capital Gains Tax Reform Tax Policy And The Economy Vol 36

Fact Check Posts Get Facts Wrong On Capital Gains Tax Proposal

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

The Unintended Consequences Of Taxing Unrealized Capital Gains U S Global Investors Commentaries Advisor Perspectives

Robinhood Ceo Reddit Co Founder Others Testify On Gamestop Stock Part 1 Cspan February 18 2021 8 39pm 1 53am Est Free Borrow Streaming Internet Archive

Cmv Unrealized Capital Gains Should Not Be Taxed R Changemyview

Swing Trading Taxes How The Capital Gains Tax Can Surprise You Vectorvest

How Could Changing Capital Gains Taxes Raise More Revenue

Unrealized Gains Losses Explained Sofi

Adam Smith Capitation And The Nonsense That Is The Proposed Aier

Gains From U S Partnership Interests By Foreign Partners Dallas Business Income Tax Services