texas estate tax calculator

It is sometimes referred to as a death tax Although states may impose their own. Your average tax rate is 1198 and your marginal tax rate is 22.

State Individual Income Tax Rates And Brackets Tax Foundation

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

. If you make 70000 a year living in the region of Texas USA you will be taxed 8387. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Texas Income Tax Calculator 2021.

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. For comparison the median home value in Hays County is. For comparison the median home value in Texas is 12580000.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. For comparison the median home value in El Paso County is. County and School Equalization 2023 Est.

Market value is the price at which a property would. An estate tax is a tax imposed on the total value of a persons estate at the time of their death. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

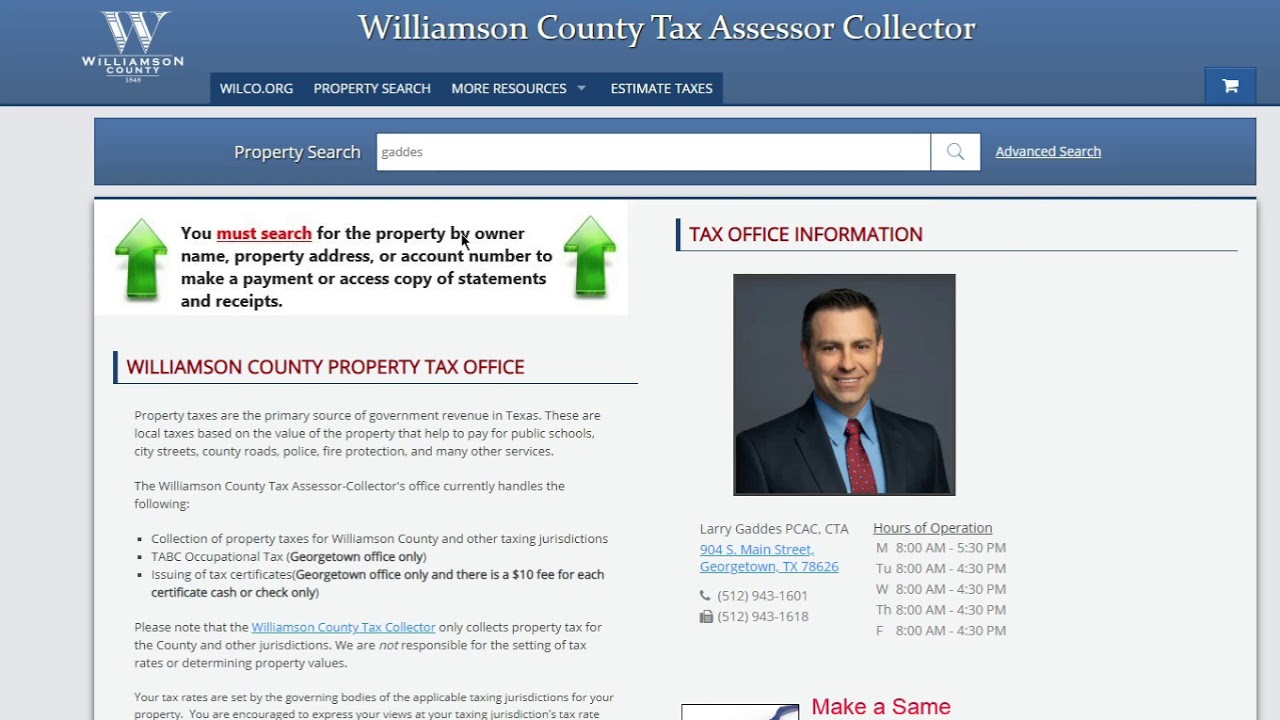

For comparison the median home value in Austin County is. Tax Rate City ISD Special. Texas Property TaxesProperty taxes in Texas are the seventh-highest in the US as the average effective property tax rate in the Lone Star State is 169.

Property tax brings in the most money of all taxes available. Calculator is designed for simple accounts. The median property tax payment in Texas is 3390 and the median home value is 200400.

Compare that to the. The calculator will show you the total sales tax amount as well as the county city and. There is no state property tax.

For comparison the median home value in Dallas County is. Harris Countys 3356 median annual property tax payment and 165300 median home value. Counties in Texas collect an average of 181 of a propertys assesed fair market.

While the state does not appraise property values set property tax rates or collect property taxes they set the operating rules for political subdivisions imposing and administering them. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Property tax in Texas is a locally assessed and locally administered tax. With few exceptions Tax Code Section 2301 requires taxable property to be appraised at market value as of Jan.

Estate Tax Rates Forms For 2022 State By State Table

How Do State And Local Individual Income Taxes Work Tax Policy Center

Es402 Introduction To Estate Gift Tax

State By State Estate And Inheritance Tax Rates Everplans

Florida Property Tax H R Block

A Guide To Estate Taxes Mass Gov

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Texas Income Tax Calculator Smartasset

Exploring The Estate Tax Part 1 Journal Of Accountancy

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

2022 2023 Tax Brackets Rates For Each Income Level

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Estate Planning 101 Your Guide To Estate Tax In Georgia

Massachusetts Estate Tax Everything You Need To Know Smartasset